What Oak Street Health got right

And what will the next generation of payvidors do differently?

CVS just bought Oak Street Health—a digital health primary care provider—for $10.5B. I’ve been impressed by Oak Street Health for a while. They’re one of the few digital health companies that nail the care model, revenue model, and technology.

Here are some observations about what Oak Street did well, as well as how the next generation of Oak Streets will be different.

What is Oak Street? A payvidor done right.

First, what is Oak Street? Oak Street is a payvidor—a primary care provider that takes on full financial risk for its patient population, like a payer. This means Oak Street has properties of both a high tech doctor’s office—like Carbon Health, Forward, or One Medical—and a health insurance startup, like Oscar, Clover, or Bright Health.

As a primary care provider, Oak Street mostly serves senior citizens, generally in-person through 100+ physical centers that they own and operate. Each physical center can care for about 3,000 patients.

Oak Street’s revenue model is different from traditional primary care providers. Their revenue is roughly the entire insurance premium—about $700 per patient per month—but in exchange, they are responsible for all downstream costs, such as emergency room visits, hospitalizations, or surgeries. So in some ways, they act like a payer. While they are not a health insurance company themselves, they partner with private payers (who take roughly a ~15% cut) or directly with Medicare (through the new ACO REACH program). This specific model is called global capitation.

How Oak Street’s financial performance compares to other payvidors

As you might expect, global capitation is an incredibly hard business model to succeed at. Many payvidor startups have been founded in the last 10 years. Oak Street’s performance is by far the best:

Ultimately, this strong financial performance is because Oak Street keeps its members healthy enough that they need to be hospitalized less often—roughly half the rate. They achieve that both through technology, and by organizing their clinical team in a unique way.

Team-based care

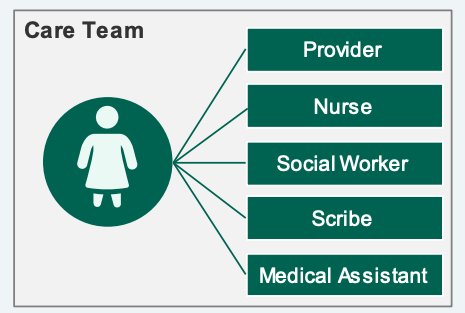

Unlike a traditional primary care provider, the doctor isn’t working alone—there’s an entire team of people caring for the patient. For patients with chronic conditions, this means nurses and social workers can help proactively reach out to the patient, adjust medications, and guide transitions in care (e.g., after a hospitalization).

This novel team-based structure is enabled by the novel revenue model. You can’t do this in a fee-for-service world, since fee-for-service fundamentally only pays for “slots” of the doctor’s time [2] . New ways of care require new business models.

Technology: present, but in the background

Canopy is Oak Street’s in-house medical record software. It hosts a variety of internal “apps”—for example, after a patient is hospitalized, a nurse will use the inpatient review app to call the patient, schedule follow-ups visits, etc, which reduce hospital readmissions by 26%. Oak Street claims they can reduce overall hospital admissions by 51%, ED visits by 51%, and 30-day readmissions by 42%.

Four things the next generation of Oak Streets will do differently

As good as Oak Street is, it was founded 11 years ago, in 2012—before COVID-19 and Virtual Care; before HealthKit, ResearchKit, and Apple Watch; before the ecosystem of digital therapeutics like Omadas, Virtas, Sword Healths, and so on; before deep learning or generative AI [3]; before modern EMRs or data platforms like Zus, Partical, Canvas, Healthie, or Elation.

If you were building Oak Street today, you’d probably keep the team-based care, the core revenue model, and aspects of Canopy.

So what will the next generation of Oak Street’s do differently?

Digital-native modalities: redefining the “visit”

While the face-to-face, 20-minute appointment has been the standard in health for years, as Jay Parkinson has pointed out, chronic conditions are more like projects to be managed over time.

COVID-19 opened the floodgates to alternative modalities: not just Zoom, but also text. Patients love these because they don’t need to take time off work or arrange childcare to travel to a physical office. They can be quite efficient.

Today’s version of “telehealth” feels a bit like a face-to-face visit over Zoom, but I think the next generation of primary care startups will create digital-native experiences—think the equivalent of Slack, Linear, or Notion.

Generative AI & few-shot learning

Once the “visit” occurs in digital form, you now have a data set to train AI models.

Generative AI has created a lot of excitement because it can, quite literally, generate text, including drafting text that a doctor could then edit. You can see how this would immediately make a physician more efficient, especially in a text-based UI.

A hidden implication is that generative models are efficient few-shot learners. In other words, they can learn to identify a new pattern—for example, diagnosing a disease or predicting the risk of a certain cause of hospitalization—given only a handful of examples. This is especially well suited for medicine, where each labeled example represents a human life at risk.

Direct-to-consumer distribution

While D2C is often thought of as Facebook ads—leading to high CACs after Apple’s ATT changes—there is plenty of room for organic, earned growth. The top Health & Fitness apps, for example, earn more than 1 million downloads per month. After Covid, many consumers have learned to be the “CEO of their health” and are actively searching for solutions, so a startup that masters consumer product design could have powerful differentiation when it comes to distribution channels.

Digital Specialist Network

For just about any condition, there’s a digital health startup that’s 100% focused on it—Livongo, Virta for diabetes, Sword or Hinge for musculoskeletal, Omada for pre-diabetes, Maven for fertility, and so on. By curating a network of high-quality digital specialists which are integrated back into primary care (e.g., sharing real-time outcomes via API), you could create a wholistic healthcare experience that’s both cheaper and better. This would be especially powerful in places that traditionally have less access to health care, such as rural areas.

Closing Notes

I’ve been working in digital health for about 10 years, and now is the most exciting time to build that I’ve ever seen. Pioneers like Oak Street have figured out scalable business models and shown real clinical value—finding the proverbial path up Mount Everest—and there are many underlying technology and societal shifts that enable the next generation of Oak Streets. It’s time to build.

Footnotes

[1] In addition to people 65 years of age and older, Medicare also covers disabled people

[2] There’s a slight exception now, if you use RPM or CCM codes.

[3] Technically, Google had deep learning in production starting in 2012. But Tensorflow was not launched till 2015, the Transformer architecture came in 2017, and of course GPT-3, DALLE, Stable Diffusion, and so on are much more recent, so a startup founded in 2012 was relatively unlikely to start with, or develop, this type of DNA.

Oak Street Health's innovative approach to primary care, focusing on value-based care and community engagement, has significantly improved patient outcomes and satisfaction. Integrating healthcare software solutions like telehealth platforms, medical billing systems, and electronic health records can further enhance such models by streamlining operations and improving patient care. For more details visit: https://www.osplabs.com/